Turkish Lira Gains Against the Dollar

Turkish lira gains against Dollar

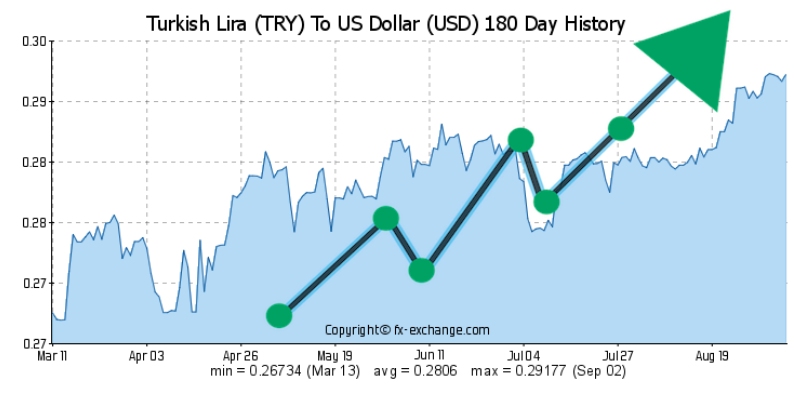

The narrative surrounding the Turkish Lira over the past

year has been nothing short of dramatic. Once a focal point of financial

discourse for its concerning depreciation, the Turkish lira gains against

Dollar have marked a significant turnaround, heralding a period of

potential prosperity for investors eyeing the Turkish market. This remarkable

recovery story has not only captured the attention of the global financial

community but has also positioned the Lira as a currency of interest for those

looking to capitalize on its undervalued status.

The Path to Recovery:

After a year or more of underperformance that grabbed

headlines for all the wrong reasons, the Turkish lira gains against Dollar

are showcasing a promising landscape for investment opportunities. The

currency's depreciation, exacerbated by the failed coup attempt and prevailing

security concerns which led to a 17 percent plummet in 2016, had cast a shadow

over economic and investor confidence. However, today's narrative is

significantly different, with the Lira emerging as the most affordable currency

among emerging markets, boasting a 15 percent appreciation against the dollar

this year alone. Analysts are optimistic, suggesting that the trajectory for

the Lira is set for even greater heights, potentially offering some of the most

lucrative returns on the global currency stage.

Investor Sentiment and Foreign Investment Surge:

The Turkish lira gains against Dollar have kindled a

renewed interest among foreign investors, poised to inject billions into

Turkey's economy. BlueBay Asset Management, a multi-billion dollar fund with

substantial investments in Turkey, has expressed confidence in the Lira's

trajectory, citing it as the cheapest since 2003 — a boon for shareholders

expecting returns ranging from 11 to 12 percent on Turkish T-bills. This

resurgence in value, coupled with Turkey's robust economic performance, has

made the Lira an attractive proposition for foreign portfolios, with an

estimated 11 to 12 billion dollars of foreign investment anticipated over the

next six months.

Economic Reforms and Growth:

The Turkish lira gains against Dollar are underpinned

by Turkey's vigorous economic reforms and a strong underlying economy. The

government's strategic measures, including tax reductions on essential goods

and incentivizing property sales to domestic and international markets,

have been pivotal in stabilizing the Lira. The banking sector's encouragement

to bolster lending at average rates of around 12 percent is a testament to

Turkey's commitment to revitalizing consumer spending and investment. These

initiatives have already begun to bear fruit, with the Gross Domestic Product

(GDP) witnessing a 5 percent increase in the year's first quarter.

Real Estate Sector — A Prime Beneficiary:

The real estate sector is a prime beneficiary of the Turkish

lira gains against Dollar. With government incentives to attract consumer spending and foreign investment, the property market is experiencing a

renaissance. Maximos Real Estate, a leading player in the Turkish property

market, has highlighted the government's efforts to stabilize the Lira as a

significant confidence booster. The influx of foreign investment will be a game-changer for the real estate industry, offering unprecedented

opportunities for property investors.

EU Investment and International Confidence:

The Turkish lira gains against Dollar have also been

mirrored in the surge of direct investment from EU countries, which rose by 61

percent year-on-year in the first half of 2017. This investment surge indicates growing international confidence in Turkey's economy and currency. The EU's substantial investment underscores the attractiveness of

the Turkish market, further buoyed by the Lira's recovery.

Conclusion:

The story of the Turkish lira gains against Dollar is

a compelling narrative of resilience and recovery. From the depths of economic

uncertainty, the Lira's rebound opens up many opportunities for

investors, particularly in the real estate sector. As Turkey continues to

implement far-reaching economic reforms and attract foreign investment, the

Lira's resurgence is not just a short-term anomaly but a harbinger of Turkey's

long-term economic potential. For investors, the current climate presents a

golden window to capitalize on the Turkish lira gains against Dollar, positioning

themselves advantageously in a market set for significant growth.

09/01/2026